Silicon Valley Unsure of Washington’s China Concerns

They call it the Trump effect.

Increased government scrutiny of Chinese investments in Silicon Valley has meant some deals are not getting done. Some aren't even considered.

Usually eager for money and tantalized by the prospect of the Chinese market, startups are even declining Chinese investment.

After years of growing ties between China and Silicon Valley, the U.S. tech capital sees itself caught between Beijing and Washington over which country will win the competition to create the next generation of communication technologies.

"China's innovation efforts are broad and deep," said Michael Wessel, commissioner of the U.S.-China Economic and Security Review Commission, at a recent congressional hearing. "China wants to be a global innovation leader and is doing all that it can legally and illegally to achieve its goals."

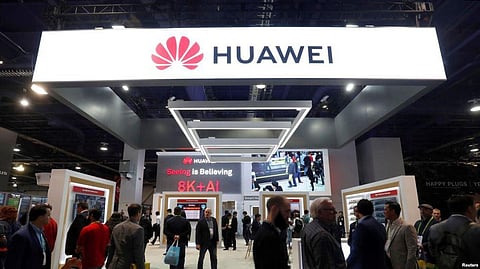

Flashpoint Huawei

Huawei, the Chinese telecommunications company that is building a 5G network in countries around the world, remains a flashpoint. Its chief financial officer faces extradition to the United States from Canada on fraud charges.

At the Mobile World Congress in Barcelona last week, U.S. and Huawei officials lobbied world leaders on whether Huawei should be trusted.

U.S. concerns about China and technology extend to the nation's methods to achieve technology dominance, as outlined in Beijing's Made in China 2025 plan.

In addition to subsidies for industry, and research and development, the U.S. says those methods include massive cyberhacking campaigns to steal corporate secrets, forced technology transfers to Chinese partners, and government policies that reward intellectual property theft.

Increased scrutiny of Chinese investors

The U.S. government wants new barriers up because it believes some technologies, such as artificial intelligence and robotics, are important to national security. But many in the tech industry see risks in new restrictions.

"By not working with China, not only do we have less access to information to what they are doing," said Parag Khanna, author of "The Future Is Asian." They will substitute us for more reliable partners and we will be cut out of the entire market."

The race to build 5G

Chinese companies are racing to build 5G wireless communication networks around the world, which Washington says risks giving Beijing enormous opportunities for electronic surveillance.

The stakes make it hard to predict how the U.S. and China will come to an understanding. In the meantime, Silicon Valley investors and entrepreneurs have accepted for now a cooling-off period for cross-border investment.

The disconnect between Silicon Valley and Washington is hard to bridge, said Christian Brose, head of strategy at Anduril Industries, a Southern California tech company that works with the U.S. government.

"When you have a conversation where one party sees China as an emerging national security challenge, and the other sees it as an emerging business opportunity, that's just a fundamental clash of cultures and expectations that is difficult to reconcile, but I also think it's not impossible," he added.

While the two countries negotiate, Silicon Valley, caught in the middle, waits. (VOA)