- Home

- NewsGram USA

- India

- न्यूजग्राम

- World

- Politics

- Opinion

- Entertainment

- On Ground

- Culture

- Lifestyle

- Economy

- Sports

- Sp. Coverage

- Misc.

- NewsGram Exclusive

- Jobs / Internships

- Interview

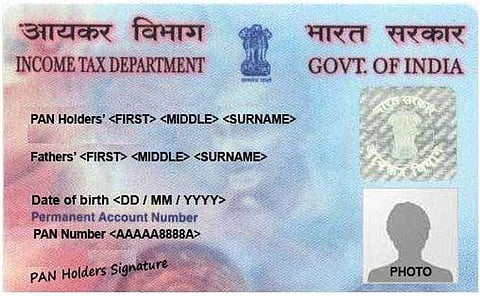

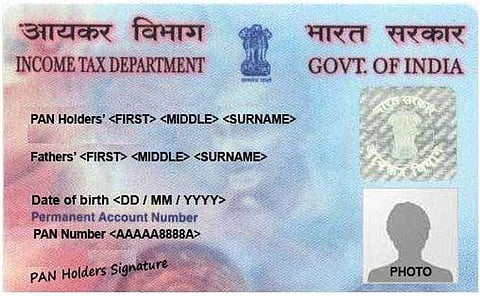

A PAN (Permanent Account Number) Card is one of the most important identity documents today in India. It is a ten-digit alphanumeric identification number given to all taxpayers by the Income Tax Department of India.

PAN is of special significance in all matters related to banking and taxes. Your PAN will be required if you want to open a bank account, apply for a loan, apply for passport, pay your taxes, buy a car and so on.

In recent times, the importance of PAN has only increased after the government has made it compulsory to link the PAN with bank accounts and to quote the PAN for any transaction exceeding Rs. 25,000.

Applying for a PAN card used to be a tedious task, but now it is considerably easy. It is an easy online process which can be completed from home itself. However, there are few things one needs to know before applying for the PAN card online:

You can apply for PAN card online, however, only partially.

You can apply for PAN online, but the process in itself is not completely online. This is because once all the online formalities and payments are done, you will still have to send an acknowledgment receipt to National Securities Depository Ltd.(NSDL) or UTI Investor Services Ltd. (UTIISL) office by post. The printed acknowledgment receipt should have your photograph and signature.

NSDL has authority to issue PAN cards. nsdl.co.in

The Payment Method

Once the documents are uploaded and form is completed, you will have to make the payment of Rs 115.90 excluding additional bank charges, if any; the amount is Rs.1020/- for dispatch outside India (The amounts are subject to change).You can pay using your debit or credit cards, Net banking or demand draft .

Fill your surname first.

While filling your application, make sure that you fill your surname before your first name. In the PAN Card, your name will appear in the sequence of 'First name Surname' only, however. This is one mistake people often make.

Do not use any prefixes while filling names out.

Do not use any prefixes such as Dr., Col., Major, etc. in the 'Name', 'Father's name' and 'Name to be printed on card' fields of the form. Also, no abbreviations or initials should be used.

PAN application should be made only on Form 49A.

A PAN application should only be made on Form 49A. It can be downloaded from the website of Income Tax department or UTIISL or NSDL. You can also get a print of it by a local printer or get it photocopied on A4 size, 70 GSM paper.

Father's name is compulsory.

Father's name is compulsorily required to be filled in the PAN application. Female applicants, irrespective of marital status, should only fill their father's name in the PAN application.

Aadhar Authentication is important for the completion of the Process.

Once the other processes and payments have been done, you will be required to undergo the Aadhar authentication process. An OTP will be sent to the mobile/email linked to your Aadhar.

What if your Aadhar Authentication failed?

In case your Aadhar authentication process is not successful or your mobile number is not linked to Aadhar, complete the full process anyway. In addition to the acknowledgement slip, you will just have to also send a photocopy of the documents uploaded by you.

Points to remember while sending the acknowledgement receipt.

You should super-scribe the envelope with 'APPLICATION FOR PAN -N-15 DIGIT ACKNOWLEDGEMENT NUMBER.' You can send this envelope via post or courier. Make sure that it should reach NSDL within 15 days from the date of online application.

Tracking the status of PAN Application

You can use your 15-digit acknowledgement number for tracking the status of your application. You can check the TIN website or SMS 'NSDLPAN (15 digit ack. no.)' to 57575. You can also and an e-mail at tininfo@nsdl.co.in or call at (020) – 2721-8080, for any PAN related inquiries.