- Home

- न्यूजग्राम

- NewsGram USA

- India

- World

- Politics

- Entertainment

- Culture

- Lifestyle

- Economy

- Sports

- Sp. Coverage

- Misc.

- NewsGram Exclusive

- Jobs / Internships

By Dora Mekouar

As once-iconic brands like Tiffany & Co., Harley Davidson and the Gap grappled with declining sales, one of the nation's largest retailers was busy making some in-store changes.

Target started offering more organic and natural food, stepped up designer collaborations with up-and-coming brands, added a line of gender-neutral children's decor, and created a showroom-style area to showcase the latest in home decor.

The in-store experience remains critical. Even though more people than ever are shopping online, just 11% of all retail sales occur over the internet. A full 89% of all retail purchases happen the traditional way, by walking into a store, according to the U.S. Department of Commerce.

Target, the 8th largest retailer in the country, made tweaks to its stores in hopes of appealing to one particular kind of consumer.

Home decor at a Target store in suburban Washington. VOA

"Target was really stuck in neutral and then was able to innovate through its stores, innovate through its digital, and, all the sudden, was able to again drive growth with millennials," says Jason Dorsey, president and lead millennial researcher at the Center for Generational Kinetics.

America's retailers are taking notice now that millennials have overtaken aging baby boomers as the country's largest living generation of adults. And it's a generation that differs from their parents when it comes to their consumer tastes. For starters, they're more adventurous and want to try something new. They're also interested in connecting with brands that feel authentic.

"What millennials tell us is that an authentic brand is candid. It has a personality. The brand itself has very distinct values, a distinct voice, and it has a candor to it that they can relate to, identify with, and trust," Dorsey says, adding that convenience is also key.

Some high-end brands, such as Gucci have successfully managed to reintroduce themselves to millennial shoppers. VOA

"This generation has been conditioned to be able to order everything through a small screen and if you make it hard or difficult or too many steps, then they're not choosing to go that route."

Millennials are expected to be big spenders over the next decade as they begin to buy and furnish new homes and start having children. Brands that fail to appeal to these influential young shoppers — who are currently in their mid-20s to late 30s — can quickly find themselves in trouble.

"Millennials are more hesitant to buy legacy big brands that they think don't really understand or get them or their priorities," Dorsey says. "You see this a lot in alcohol where you've seen a move away from your Bud Light, Coors Light, those type of brands and into craft beers, things that are seen as more unique, hard ciders, just a variety of other options that millennials feel better represents them, sort of more of a unique experience."

Being seen as not unique or different has had an impact on brands the baby boomer generation — those between 55 and 75 — once helped make iconic.

Harley Davidson motorcycles are on display at a dealership in Ashland. VOA

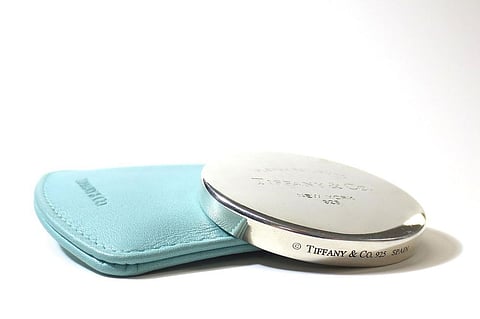

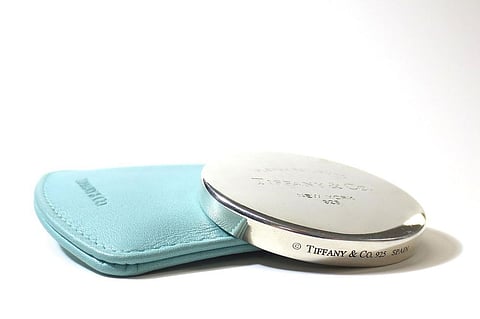

After an extended sales slump, Tiffany & Co. is currently in the process of being acquired by the same French luxury group that owns Louis Vuitton and Sephora. Millennials haven't shown much interest in the 200-year-old retailer's signature rings, necklaces and bracelets that were once prized by their parents.

Harley Davidson motorcycles, which represented freedom and the unlimited possibilities of the open road to older generations, now faces being left behind by millennials who are more interested in using ride-sharing apps to get around.

GAP is one of the most popular brands among millennials. VOA

Harley-Davidson recently reported its worst quarterly sales in recent history, continuing a slide that began in 2014.

And there was a time when American teenagers thought nothing was cooler than wearing the Gap's chino pants and branded sweatshirts. But today's hipsters aren't buying the retailer's offerings, which industry experts say haven't changed much in the last 20 years.

How millennials want to be seen, particularly through social media, is another big driver of millennial purchases, according to Dorsey.

"You know millennials are the most photographed generation of adults in history," he says. "How millennials want to see themselves really impacts what they buy in terms of, 'Does this brand, product or service alignment my values? Does the store … treat people well? If it's a restaurant, is the food responsibly sourced?' All of these things are suddenly playing in that consumer narrative."

The good news for retailers is that millennial dollars are still very much up for grabs, but it is up to the brands to figure out how to appeal to young shoppers who have very specific ideas about how and what they want to eat and buy. (VOA)