- Home

- न्यूजग्राम

- NewsGram USA

- India

- World

- Politics

- Entertainment

- Culture

- Lifestyle

- Economy

- Sports

- Sp. Coverage

- Misc.

- NewsGram Exclusive

- Jobs / Internships

By Ankita Kumari

Have you ever wondered why buying a car in India today feels more like upgrading a smartphone than purchasing a piece of heavy machinery? As of January 2026, the automotive landscape has undergone a radical shift, with "horsepower" being replaced by "processing power" and "fuel economy" by "sustainability footprints."

As per the latest automotive market news, Indian consumers are no longer just looking for a way to get from point A to point B. In fact, they are demanding vehicles that act as connected living spaces, powered by clean energy and supported by transparent, digital-first business models.

To stay relevant, automakers like Tata, Maruti Suzuki, and Mahindra are completely rewriting their playbooks to match these new urban priorities. Go through this article until the end to get the entire detail regarding this subject.

See Also: Odisha unveils draft EV Policy 2025 to boost green mobility

Automakers are rewriting their strategies by shifting their focus from solely manufacturing cars to providing integrated mobility solutions and digital experiences. It is driven by consumer demand for electrification, connectivity, and flexible ownership models. Automakers are currently shifting from simply selling cars to becoming experience providers.

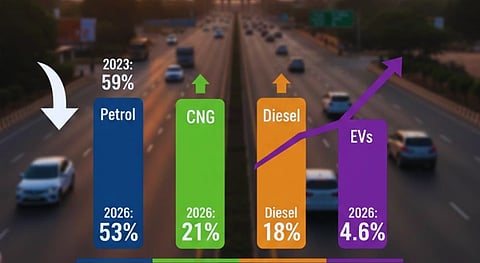

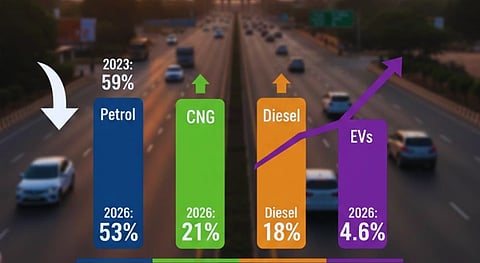

In 2026, electric vehicles (EVs) have officially moved from being "expensive toys" for the elite to becoming the primary family vehicle for middle-class India. According to The Hindu (2025), 2026 is the year affordable EVs finally go mainstream, led by the full-scale entry of the Maruti Suzuki e-Vitara and Hyundai’s mass-market urban EVs.

Automakers are no longer just building cars. They are building entire energy ecosystems. Major players are investing heavily in ultra-fast charging hubs along national highways to eliminate the "range anxiety" that previously held buyers back.

This shift is driven by a desire to lower the Total Cost of Ownership (TCO), as reported in automotive market news. With January 2026 bringing an average 3% price hike across the board due to rising raw material costs, the long-term fuel savings of an EV have become a major strategic selling point. Sustainability is no longer just a "green" checkbox; it is a core business strategy designed to protect consumers from the change of traditional fuel prices.

The car of 2026 is now a "Software-Defined Vehicle" (SDV), where the driving experience is determined more by lines of code than by engine size. For today's tech-savvy buyer, features like Over-the-Air (OTA) updates and Level 2+ ADAS (Advanced Driver Assistance Systems) are no longer optional "add-ons"—they are the core product.

See Also: PM E-DRIVE: Centre rolls out Rs 2,000 crore subsidy scheme for EV charging stations

Brands are adopting architectures that allow cars to "get better with age." Just like your phone receives security patches, your car can now receive a software update overnight that improves battery efficiency or adds a new safety feature.

As reported by Professionals, software is now responsible for nearly half of a vehicle's development cost. This allows manufacturers to maintain a continuous digital relationship with you, moving away from the old "sell and forget" model. Whether it’s a predictive maintenance alert before a road trip or a remote cooling feature during a Delhi summer, software is the new soul of the machine.

The traditional dealership visit is being replaced by "Direct-to-Consumer" (D2C) digital showrooms that prioritize transparency and flexible ownership. Data from the 2026 Global Automotive Consumer Study shows that buyers are increasingly frustrated with inconsistent showroom experiences and are instead looking for a "hassle-free, digitalized" journey.

According to automobile latest updates, automakers are responding by experimenting with subscription-based models and agency sales. You might not "buy" a car in the traditional sense anymore; instead, you might subscribe to one for 24 months, with insurance, maintenance, and even software upgrades bundled into a single monthly fee.

This shift allows companies to create a steady stream of revenue while giving you the freedom to upgrade to the latest model more frequently without the headache of resale. The dealership is evolving from a sales floor into an "experience hub" where you go to touch the materials and test the tech, rather than haggle over price.

To combat global supply shocks and the January 2026 price hikes, Indian automakers are localizing their supply chains to ensure they can deliver cars on time. The industry has moved toward "Deep-Tech" partnerships, in which traditional car companies work side by side with battery specialists and software startups.

By bringing the production of critical components like lithium cells and semiconductor chips to Indian soil under the PLI (Production-Linked Incentive) scheme, brands are buffering themselves against a weaker rupee and international trade volatility.

This resilient approach is what allows them to manage inventory better and avoid the massive waiting periods that plagued the market in previous years. Furthermore, the focus has shifted toward "Circular Economy" practices, where manufacturers are already planning for battery recycling and part refurbishment to simultaneously lower costs and environmental impact.

The most interesting trend in 2026 is the "Premiumisation" of the budget segments, where even entry-level cars now feature high-end tech. Buyers are no longer willing to settle for basic interiors just because they are buying a sub-compact car. This has forced automakers to rethink their "Luxury" strategy. Instead of selling status through a badge, they are selling value through features.

We are seeing a rise in "Feature-Rich" models that bridge the gap between mass-market and luxury brands. Panoramic sunroofs, ventilated seats, and high-fidelity sound systems are becoming standard in vehicles priced under ₹15 Lakh. This shift in consumer priorities is the primary reason why the mid-size SUV segment is expected to be the largest-selling category in India by the end of 2026.

As automobile latest updates suggest, the shift toward electric power, smarter software, and flexible ownership is making the driving experience better for everyone. While the January price hikes are a hurdle, the long-term value of these high-tech, sustainable cars is hard to ignore. Whether you are looking for your first EV or a connected SUV, staying tuned to automotive market news ensures you make a choice that fits your future.

Suggested Reading: